Bitcoin Optimism Surges: 80% of Poll Respondents Expect Growth

Written on

Chapter 1: Overview of Bitcoin Sentiment

Recent research indicates a significant degree of optimism regarding Bitcoin's potential growth in value this year. Sponsored by Luno—a platform designed for purchasing, saving, and managing cryptocurrencies—a study conducted by U.K.-based analytics firm 3Gem surveyed a diverse demographic across the U.K. This survey encompassed various ages, genders, and locations, ensuring a well-rounded perspective.

The findings revealed that a substantial proportion of participants believe Bitcoin's price will rise in 2022. Bitcoin, recognized as the largest cryptocurrency by market capitalization, operates on a decentralized peer-to-peer network facilitating secure transactions.

Bitcoin was introduced in 2009 by the anonymous figure Satoshi Nakamoto and is distinguished from traditional fiat currencies by several key characteristics. Its decentralized nature allows it to function independently of governmental or central bank interventions. New bitcoins are created through a process known as mining, where network computers validate transactions. Miners receive bitcoin as a reward for their efforts. The inflation rate of Bitcoin decreases approximately every four years during events referred to as “halvings.” Currently, over 19 million bitcoins have been mined, with the total supply capped at 21 million, expected to be fully mined by around 2140. The Bitcoin network documents every transaction in blocks, forming a transparent and immutable ledger known as the blockchain.

"This research highlights the ongoing optimism surrounding Bitcoin and digital currencies, suggesting that we are still in the early stages of their adoption."

Section 1.1: Survey Insights

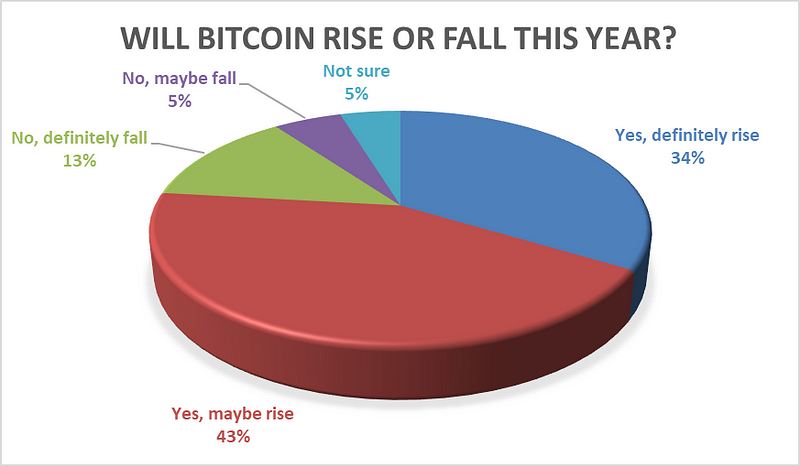

3Gem’s poll results indicate a promising outlook for Bitcoin and other digital assets. The survey revealed that nearly 77% of respondents believe Bitcoin's price will “definitely” or “maybe” increase, while only 18.5% anticipated a decline. Approximately 5% of participants expressed uncertainty regarding Bitcoin's future performance.

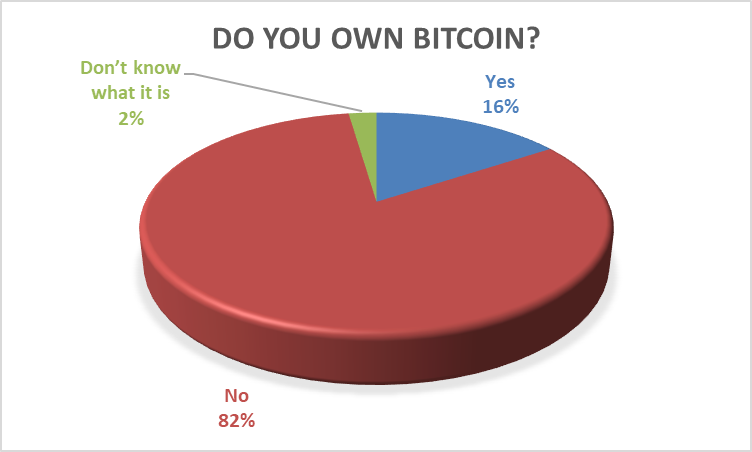

The survey also gathered data on Bitcoin ownership, suggesting that adoption in the U.K. remains in its early phases. Only 16% of respondents reported owning Bitcoin, while 82% indicated they did not. Additionally, 2% were unaware of what Bitcoin is.

Among the 1,000 individuals surveyed, all aged 18 and older, the average age was slightly over 46. Participants hailed from nine distinct regions across England, as well as Scotland, Wales, and Northern Ireland. The demographic breakdown showed 51% identified as female and 49% as male.

Section 1.2: Conclusion on Digital Assets

Digital currencies like Bitcoin present investors with both volatility and the potential for significant returns compared to traditional assets. For instance, in October 2013, Bitcoin was valued at less than $200; by October 2018, it surged past $6,000, and by October 2021, it reached an impressive $60,000. These remarkable gains have fostered a positive outlook among many investors.

As Satoshi Nakamoto aptly noted, “It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy.”

Chapter 2: Video Insights on Bitcoin Market Trends

This video discusses the prevailing optimism in the market for Bitcoin as we look toward the coming year, featuring insights from Grayscale's CEO.

This video provides an analysis of potential Bitcoin price targets as we approach the end of the year, offering valuable forecasts for investors.

This content serves an educational purpose and should not be taken as trading advice. Past performance is not indicative of future results. Always invest cautiously and never more than you can afford to lose. The author of this article may hold assets mentioned herein.

If you enjoyed this content and are interested in commissioning your own analysis, consider exploring Quantum Economics’ Analysis on Demand service.